Kensetsu Platform

Theory

Overall description of the platform

Kensetsu is an overcollateralised stablecoin platform, starting with a stable asset pegged to USD. It is a MakerDAO analogue in the SORA ecosystem. The native token for the Kensetsu platform is the KEN token, which is used for farming and protocol rewards.

Key Features - KUSD borrowing (available collateral, parameters). Fee Calculation Process

A Vault is the primary entity which operates on the Kensetsu platform. The Vault has the following parameters;

- Collateral token — A token that operates as collateral in borrowing operations. The Kensetsu platform operates with six key tokens: XOR, VAL, TBCD, PSWAP, ETH, and DAI.

- Debt in borrowed token - This shows the amount of debt that the user borrowed. The Kensetsu platform allows the borrowing of KUSD tokens pegged to USD.

- Collateral amount - Displays how much a user has deposited in the collateral token to secure the loan.

- Available to borrow - Indicates how much a user can borrow until their vault becomes liquidated.

- LTV (loan-to-value) - The debt ratio to the collateral value in your vault, calculated as a percentage.

- Stability Fee - An annual fee on the amount drawn from your vault, calculated as a percentage.

- Borrow tax - a tax applied to borrowing amount, it is set as 1%.

- Liquidation penalty - a fee applied if the value of your collateral falls below a certain threshold, prompting the sale of assets to cover debt. This penalty increases debt.

Key actions available for Users:

- Create a vault — This operation allows users to create a vault in the Kensetsu platform. Users must deposit some collateral tokens to create a vault. Users can not create empty vaults with collateral tokens, but they can create a vault without borrowing tokens.

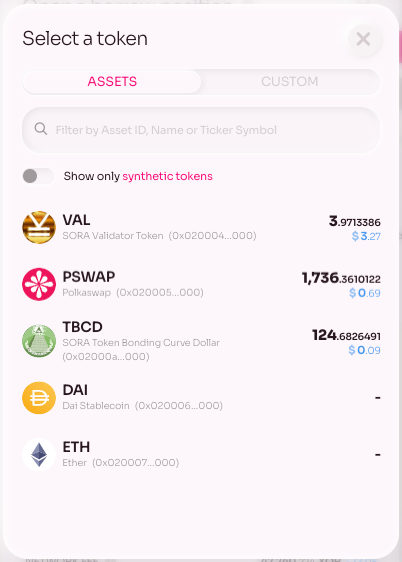

The collateral tokens available in Kensetsu are:

XOR -

0x0200000000000000000000000000000000000000000000000000000000000000VAL -

0x0200040000000000000000000000000000000000000000000000000000000000PSWAP -

0x0200050000000000000000000000000000000000000000000000000000000000TBCD -

0x02000a0000000000000000000000000000000000000000000000000000000000ETH -

0x0200070000000000000000000000000000000000000000000000000000000000DAI -

0x0200060000000000000000000000000000000000000000000000000000000000Deposit collateral — Users can add collateral to make the LTV ratio safer and borrow more.

Borrowing—Users borrow KUSD tokens, which are pegged to the USD value. The amount of tokens available to borrow is calculated based on the risk parameters of the Kensetsu platform. Users can borrow tokens in existing vaults if the tokens available to borrow are more than zero.

RepayDebt - Users can repay their borrowed token debt, making the vault healthier and preventing its liquidation. To repay their debt, users must have enough of the borrowed token to repay all fees.

Close Vault - Repays outstanding debt and gets back all deposited collateral. It will fail if the user does not have enough KUSD to cover debt. This action destroys CDP.

Liquidation - Liquidation is the vault's process of selling the collateral token. Kensetsu will liquidate some of the collateral tokens until the LTV (loan-to-value) metric becomes less than the liquidation threshold.

INFO

How to avoid a vault’s liquidation?

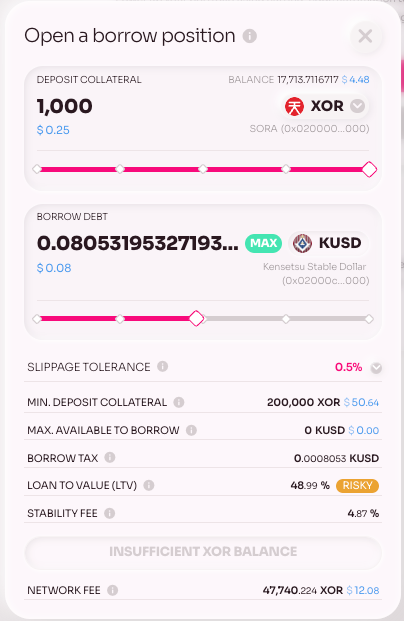

- Borrowing tokens with less than 50 % LTV — It will take you enough time to pay the stability fee and protect yourself in case the collateral token fluctuates.

- Add collateral—Kensetsu allows the deposit of additional collateral tokens, which decreases the LTV.

How is the stability fee utilised (buyback, burn, farming)

The stability fee that will be charged from these vaults will be used in a stability fund with several purposes:

- Stabilising KUSD - Maintains peg stability by covering bad debt.

- Incentivization program - buyback of KEN token and sending KEN token as a reward to XOR-KUSD LP token holders in the Demeter farming platform.

Practice

How to Open a Kensetsu Vault

- Navigate to Polkaswap.io/#/vaults

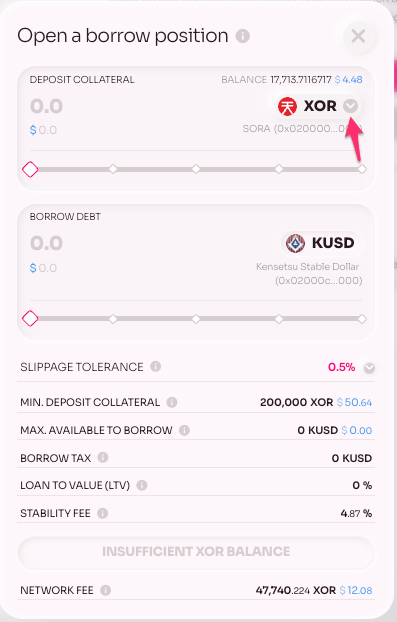

The vault creation interface has several input fields:

- Deposit collateral amount - this field corresponds to the collateral token.

- Borrow debt - this field corresponds to the amount of KUSD borrowed.

- Transaction details - Here, you will see a summary of the information about the created vault and transaction details.

- Select the source asset (the asset you'd like to use as collateral). Click on the asset drop-down menu to select them.

The assets from your wallet will be listed by default. It currently supports the 6 collateral tokens. You can find and add any asset by entering its ID or name in the search field. Whitelisted assets will be listed.

- To open a borrow position, enter the asset you want to set as collateral.

These are the parameters visible on the Open Position interface:

- Slippage tolerance—The amounts on the screen are calculated for the moment you're borrowing. The exchange rate might change before you sign and send the transaction. Your transaction will be reverted if the price changes unfavourably by more than this percentage.

- Min. Deposit Collateral- These are the minimum assets required to create a vault. This initial deposit collateral secures the funds you wish to borrow.

- Max. Available to Borrow- This is the maximum amount you can draw from your vault, determined by the value of your collateral. This limit adjusts as the value of the collateral changes.

- Borrow Tax- This is a 1% tax applied to the borrowed amount.

- Loan to Value This is the ratio of the amount drawn to the value of your collateral in your vault, expressed as a percentage. A higher LTV increases potential returns and risk, including the chance of liquidation.

- Stability Fee—This is an annual fee calculated as a percentage of the amount drawn from your vault.

- Network Fee- This is the network transaction fee (gas).

- If you're ready to borrow, click Open Vault. Then, check the details carefully, and if everything is okay, confirm and sign the transaction.

Congratulations, you have successfully set up your Kensetsu vault.